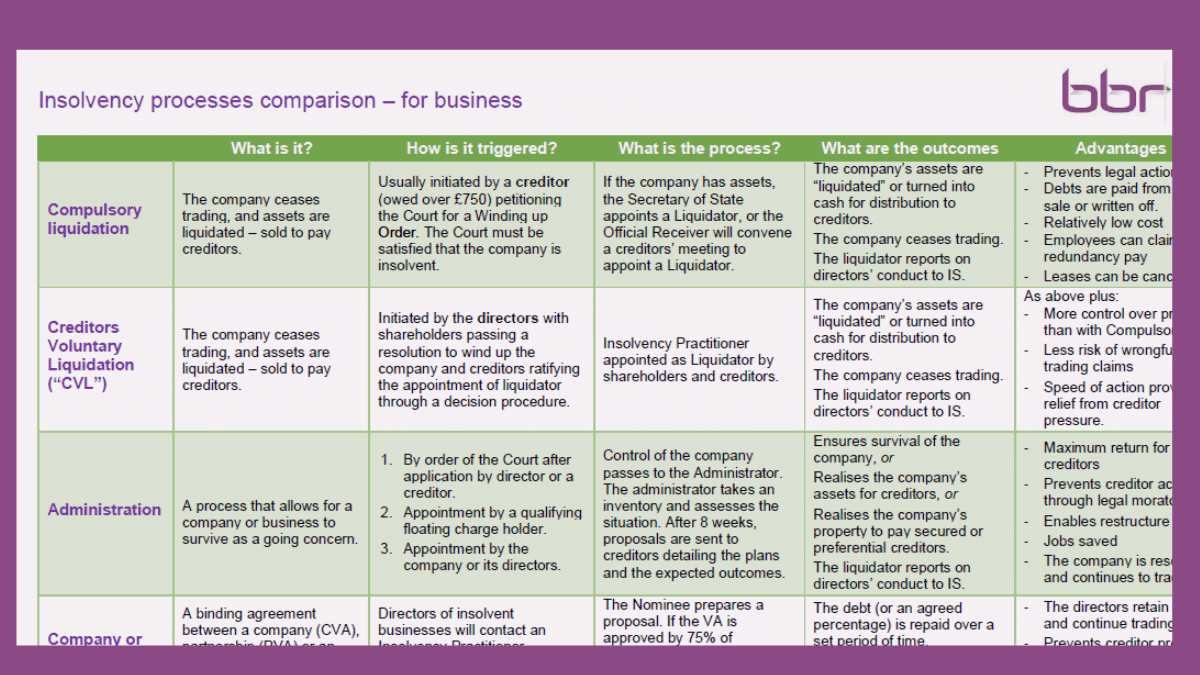

A one-page guide to insolvency processes

Business insolvency processes – the key points, pros and cons listed in this handy one-page table

Download here (pdf): Insolvency comparison – for businesses

Or, for a more in-depth overview on each of these insolvency procedures, scroll down…

- Compulsory Liquidation (Company winding-up – led by Creditors)

- Creditors Voluntary Liquidation (“CVL”) (Company winding-up – led by Directors / Shareholders)

- Administration (Rescues the business or part of the business)

- Company, Partnership of Individual Voluntary Arrangement (Rescues the company)

- New Moratorium (Led by directors)

1. Compulsory Liquidation (Company winding-up – led by Creditors)

The company ceases trading, and assets are liquidated – sold to pay creditors.

Trigger

This process is usually initiated by a creditor of the company who is owed over £750 petitioning the Court for a Winding up Order.

The Court must be satisfied that the company is insolvent. One way to demonstrate insolvency is for a creditor to issue a statutory demand and the company failing to pay the debt demanded within 21 days. A company, its directors and its shareholders may also petition for the company to be wound up.

What happens

Once a Winding up Order is made the Official Receiver automatically becomes the Liquidator.

If the company has assets, the Secretary of State will usually appoint a Liquidator in place of the Official Receiver or the Official Receiver will convene a creditors’ meeting to appoint a Liquidator. The company’s assets are “liquidated” or turned into cash for distribution to creditors.

Consequences

See next section “Consequences of Liquidations”.

2. Creditors Voluntary Liquidation (“CVL”) (Company winding-up – led by Directors / Shareholders)

The company ceases trading, and assets are liquidated – sold to pay creditors.

Trigger

A CVL is initiated by the directors who pass a resolution proposing separate meetings of the company’s shareholders (known as “members”) and creditors be convened for the purposes of placing the company into liquidation and to appoint a Liquidator. The directors will nominate a Licensed Insolvency Practitioner to assist in this process and to accept the appointment as Liquidator.

What happens

At the meeting of members, the resolution to wind up the company must be approved by a 75% majority of members voting at the meeting in person or represented by proxy. At the creditors’ meeting, the creditors may either confirm the appointment of the Liquidator appointed by the members or nominate another of their choosing. Voting at the creditors’ meeting is by a majority (in value) or creditors voting either in person or represented by proxy.

Consequences of liquidations

Liquidation is the most commonly used procedure for insolvent companies. Liquidation signals the end of a company’s trading. Once the liquidation is concluded the company is dissolved. Most companies that go into insolvent liquidation have already ceased trading, and it’s very unusual for a liquidator to carry on trading in order to sell the business or assets as a going concern.

The appointed liquidator is obliged to carry out a statutory investigation into the affairs of the Company and the conduct of the directors and to report their findings to the Insolvency Service (“IS”). Should the IS consider the conduct of the director to be unfit they may commence director disqualification proceedings.

3. Administration (Rescues the business or part of the business)

A process that allows for a company or business to survive as a going concern.

Trigger

There are three routes for a business (or a partnership) to enter Administration:

- By order of the Court after application by the company director or a creditor.

- Appointment by a qualifying floating charge holder.

- Appointment by the company or its directors.

Administration must fulfil one of the following purposes:

- Rescuing the company (as opposed to the survival of the business that the company carries on) as a going concern; or if it is not reasonably practicable

- Achieving a better result for the company’s creditors as a whole than would be likely if the company were wound up (without first being in administration); or if 1) and 2) are not reasonably practicable

- Realising property in order to make a distribution to one or more secured or preferential creditors.

The Administrator is an officer of the Court and has a duty to act in good faith and in the interests of the company’s creditors.

What happens

Control of the company passes to the administrator who has 8 weeks to assess the situation, beginning with an inventory of company assets that may be used to repay the creditors.

The Administrator is an agent of the company and is empowered to do anything necessary for the management of the affairs, business and property of the company. An Administrator is able to continue trading a company in appropriate circumstances.

In many cases Administration leads to the sale of the company’s business as a going concern. The sale of assets may be agreed before the company goes into Administration and completed immediately after the start of Administration. This is commonly known as a “Pre-Pack” or “Pre-Packaged Administration”.

Once the administrator has assessed the situation detailed proposals are distributed to creditors outlining the strategy and how debts are to be repaid along with expected outcomes. If a pre-pack sale is planned, proposals will include a report as to why this was considered appropriate.

Assets sold by the Administrator must be valued by an independent professional valuer.

Consequences

Administration stops any legal actions being taken against a company or from proceeding unless the Administrator or the Court give their permission. A “Pre-Pack” can ensure a smooth transition with minimal disruption to the business, preserving its goodwill and enhancing returns for creditors. Employees generally remain employed, transferring to the purchaser of the assets under the TUPE regulations (Transfer of Undertakings (Protection of Employment) Regulations 2006. Administration ends automatically after one calendar year, unless the creditors agree to an extension. There are four routes to exit:

- Liquidation

- Company Voluntary Arrangement

- Dissolution

- The company may be returned to its directors on the very rare occasion that the company has returned to solvency.

As with liquidation, the Administrator is required to report to the IS on the conduct of the Company’s directors.

4. Company, Partnership of Individual Voluntary Arrangement (Rescues the company)

A legally binding agreement between a company (“CVA”), partnership (“PVA”) or an individual (“IVA”)and their unsecured creditors to repay all or part of their debt over a fixed period of time.

Trigger

A CVA, PVA and IVA (sole traders) offers a solution to businesses currently in distress, are insolvent but still viable as a going concern.

A VA is administrated by a Licensed Insolvency Practitioner who will act in the capacity of Nominee, pending the approval of the Arrangement, and then as Supervisor once the Arrangement comes into effect. The Nominee assists the company, partnership or individual in preparing a proposal to present to the creditors. (The proposal cannot change the rights of secured or preferential creditors without their consent).

The Nominee will usually contact major creditors in advance to ascertain whether they would be likely to support the proposed VA. The Nominee sends the proposal to all creditors along with notice of a meeting of creditors at which they will be able to approve, reject or modify the proposal.

What happens

A proposal must be approved by 75% in value of creditors present or voting by proxy at the meeting of creditors. Once a VA is approved by unsecured creditors it binds all creditors, whether or not they voted or attended the creditors meeting.

Creditors who did not receive notice of the meeting are also bound by the Arrangement, although they do have a short period of time to apply to the Court for the approval of the Arrangement to be reserved. Such an application is only likely to succeed if the creditor can prove that they were unfairly prejudiced.

The Supervisor’s role is to monitor the VA to ensure that the company, partnership or individual complies with their obligations under the terms of the VA and to distribute funds to creditors. Once the VA is approved creditors will be unable to take any alternative action to recover their debt in full.

Consequences

A VA is flexible, but usually lasts for a fixed time period where the debt (or an agreed percentage) is repaid under terms agreed with unsecured creditors in full and final settlement. Repayment may be made by means of a single lump sum payment or by regular contributions from income.

The directors, partners or individual will remain in control of their business during the period of the VA but will be required to provide the Supervisor with regular accounting information. The viability of the business is demonstrated by detailed cash flow forecasts for periods up to five years.

If the company, partnership or individual fails to comply with the terms of the Arrangement the Supervisor may be empowered to present a petition for the company or partnership to be wound up or the partners or individual to be made bankrupt.

There is no obligation on the Supervisor to report to the IS regarding the directors’ conduct as there is with liquidation and administration.

5. New Moratorium (Led by directors)

Allows breathing space to operate while preventing creditors from taking action).

The Corporate Insolvency and Governance Act 2020 introduced a new debtor-in-possession moratorium to give companies breathing space to rescue their company.

Trigger

A company may enter a moratorium by:

- the directors filing relevant documents at court (the out-of-court process).

- the directors making an application to the court (the in-court process).

It allows directors to continue to operate but with an insolvency practitioner acting as “Monitor” overseeing the company’s affairs. The Monitor must believe that a rescue of the company will be possible. If the monitor is no longer of the view that rescue is possible, the moratorium must end. Creditors do not need to consent or be given notice of the arrangement prior to filing the documents at court.

What happens

The moratorium provides 20 business days protection from certain creditor action. It can be extended for a further 20 business days without any consent, and may also be extended for up to 12 months with the consent of creditors and/or a court.

During the moratorium period, creditors are prevented from:

- crystallising their charge or appointing an administrator

- commencing insolvency proceedings

- enforcing security (without consent of the Monitor or court) or repossessing goods (without court consent);

- taking or continuing legal processes (except certain employment claims) without court consent

- forfeiting leases (landlord) without court consent

- taking security over the company’s property (without the Monitor’s consent);

- applying to court to enforce their debt.

Consequences

During the moratorium, the company must continue to pay certain debts including:

- new liabilities (including the fees of the Monitor)

- payment for new goods or services,

- rent due during the moratorium period

- certain payments due to employees

- debts under financial contracts. If those debts are not paid, the moratorium will end.

The company and directors are also bound by numerous restrictions and obligations, including:

- a £500 restriction on credit

- inability to enter into certain types of contract

- a threshold on payment of pre-moratorium debt without the Monitor’s consent.