Insolvency statistics released for June 2022

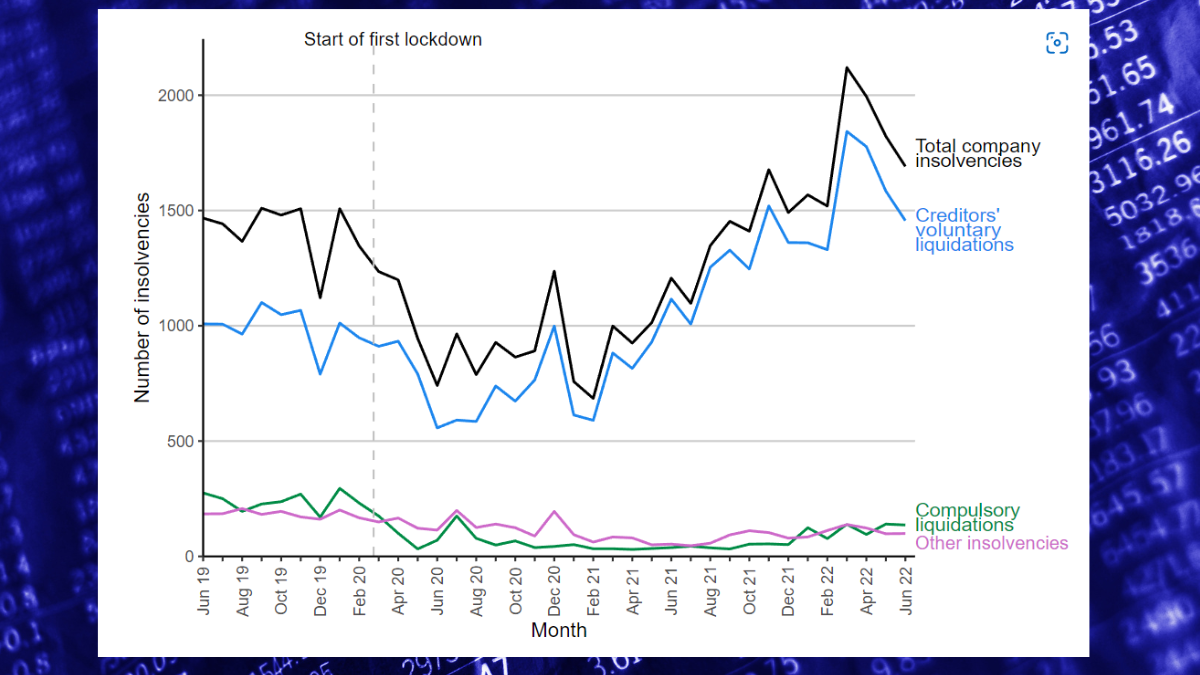

High insolvency rates are driven by the increasing number of CVLs

The number of registered company insolvencies in June 2022 was 1,691:

- 40% higher than in the same month in the previous year (1,207 in June 2021), and

- 15% higher than the number registered three years previously (pre-pandemic; 1,467 in June 2019).

In June 2022 there were 1,456 Creditors’ Voluntary Liquidations (CVLs), 30% higher than in June 2021 and 44% higher than June 2019. Numbers for other types of company insolvencies, such as compulsory liquidations, remained lower than before the pandemic, although there were 3.6 times as many compulsory liquidations in June 2022 as in June 2021, and the number of administrations was 2.3 times higher than a year ago.

For individuals, 471 bankruptcies were registered, which was 37% lower than in June 2021 and 64% lower than June 2019.

Corporate Insolvencies

Of the 1,691 registered company insolvencies in June 2022:

- There were 1,456 CVLs, which is 30% higher than in June 2021 and 44% higher than in June 2019;

- 136 were compulsory liquidations, which is 258% (3.6 times) higher than June 2021, but 51% lower (half the number) than June 2019;

- Eight were CVAs, which is 43% lower than June 2021 and 77% lower than June 2019;

- There were 90 administrations, which is 131% (2.3 times) higher than June 2021 but 40% lower than June 2019; and

- There was one receivership appointment.

Between 26 June 2020 and 30 June 2022, in England & Wales, 39 moratoriums were obtained and 12 companies had a restructuring plan registered at Companies House. These two new procedures were created by the Corporate Insolvency and Governance Act 2020.

Impact of COVID-19 business support measures

Lower numbers of compulsory liquidations is likely to be partly driven by government measures put in place to support businesses and individuals during the pandemic, including:

- Temporary restrictions on the use of statutory demands and certain winding-up petitions (leading to company compulsory liquidations).

- Enhanced government financial support for companies and individuals.

As the Insolvency Service does not record whether an insolvency is directly related to the coronavirus pandemic, it is not possible to state the direct effect of the pandemic on insolvency volumes.

Debt relief orders and bankruptcies

There were 1,815 DROs and 471 bankruptcies in June 2022 in England & Wales.

The bankruptcies were made up of 401 debtor applications and 70 creditor petitions. Monthly bankruptcy numbers between July 2021 and June 2022 were lower than the numbers in 2020, which were already lower than pre-pandemic levels.

Bankruptcies were 37% lower than in June 2021. Debtor applications were 38% lower and creditor petitions were 33% lower than June 2021.

Compared to June 2019, total bankruptcies were 64% lower; debtor applications were 61% lower and creditor petitions were 74% lower.

Individual voluntary arrangements

There were, on average, 7,575 IVAs registered per month in the three-month period ending June 2022, 6% higher than for the three-month period ending June 2021 and 17% higher than the three-months ending June 2019.

Breathing Space Registrations

In June 2022 there were 5,772 breathing space registrations. This is 2% higher than the number in June 2021.

Of the 5,772 Breathing Space registrations in June 2022:

- There were 5,687 Standard breathing space registrations, which is 2% higher than the number in June 2021.

- There were 85 Mental Health breathing space registrations, which is 35% higher than the number in June 2021.

Advice

We publish a summary of the reports here each month. For advice relating to support, insolvency or recovery options, please contact us.

* This content and data was reported in full in the Insolvency Service Statistics for June 2022 published 15 July 2022 – see the full report here:

Monthly Insolvency Statistics, June 2022 – GOV.UK (www.gov.uk)

Image source: The Insolvency Service Monthly insolvency statistics, June 2022