Insolvency statistics released for March 2022

Insolvencies have risen by 27% since last month

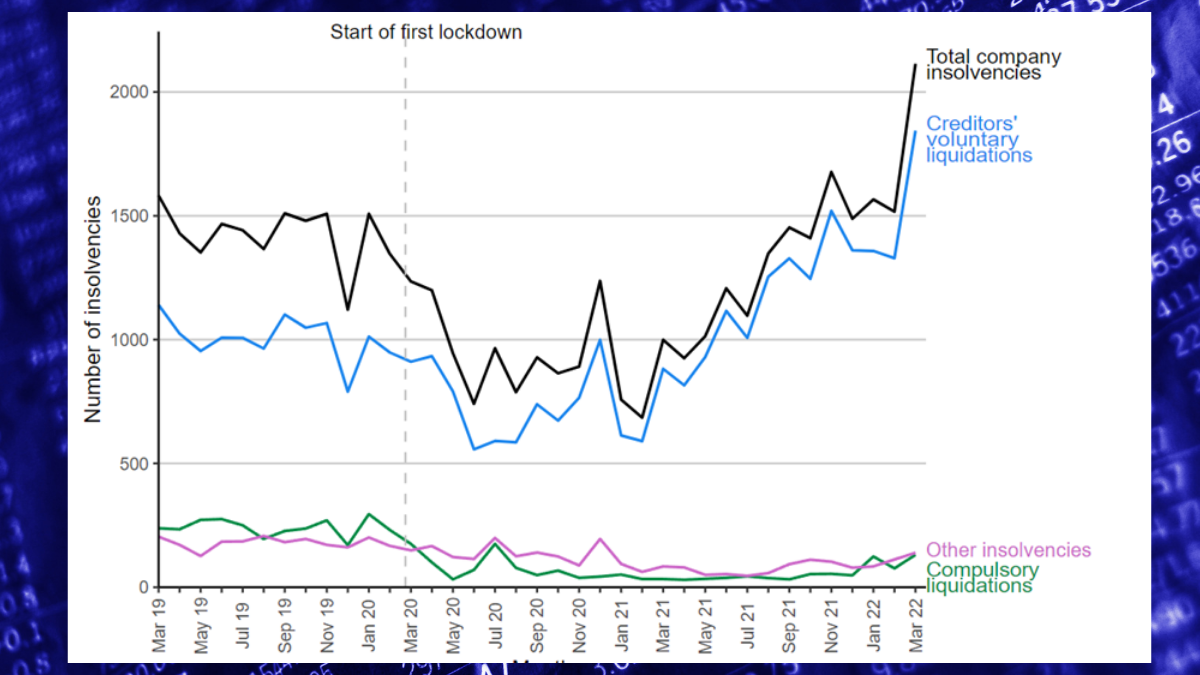

The number of registered company insolvencies in March 2022 was 2,114:

- More than double the number registered in the same month in the previous year (999 in March 2021), and

- 34% higher than the number registered three years previously (pre-pandemic; 1,582 in March 2019).

For individuals, 633 bankruptcies were registered, which was 39% lower than in March 2021 and 59% lower than March 2019.

Corporate Insolvencies

Of the 2,114 registered company insolvencies in March 2022:

- There were 1,844 CVLs, which is 109% (2.1 times) higher than in March 2021 and 62% higher than in March 2019;

- 131 were compulsory liquidations, which is 297% (3.97 times) higher than March 2021, but 45% lower than March 2019;

- 10 were CVAs, which is the same as March 2021 but 66% lower than March 2019;

- There were 129 administrations, which is 74% higher than March 2021 but 26% lower than March 2019; and

- There were no receivership appointments.

Between 26 June 2020 and 31 March 2022, in England & Wales, 36 moratoriums were obtained and 10 companies had a restructuring plan registered at Companies House. These two new procedures were created by the Corporate Insolvency and Governance Act 2020.

Impact of COVID-19 business support measures

Lower numbers of compulsory liquidations is likely to be partly driven by government measures put in place to support businesses and individuals during the pandemic, including:

- Temporary restrictions on the use of statutory demands and certain winding-up petitions (leading to company compulsory liquidations).

- Enhanced government financial support for companies and individuals.

As the Insolvency Service does not record whether an insolvency is directly related to the coronavirus pandemic, it is not possible to state the direct effect of the pandemic on insolvency volumes.

Debt relief orders and bankruptcies

There were 2,512 DROs and 633 bankruptcies in March 2022 in England & Wales.

The number of DROs in March 2022 was 58% higher than in March 2021, and 3% higher than in March 2019. This is the first time since the start of the pandemic that numbers have been higher than the pre-pandemic comparison month. Changes to DRO eligibility came into effect on 29 June 2021, including an increase in the level of debt at which people can apply for a DRO from £20,000 to £30,000 (as indicated on Figure 3). The increase in the number of DROs registered since June 2021 is likely to have been caused by this expansion of the eligibility criteria.

The bankruptcies were made up of 549 debtor applications and 84 creditor petitions. Monthly bankruptcy numbers between July 2021 and March 2022 were lower than the numbers in 2020, which were already lower than pre-pandemic levels.

Bankruptcies were 39% lower than in March 2021. Debtor applications were 41% lower and creditor petitions were 20% lower than in March 2021.

Individual voluntary arrangements

There were, on average, 7,136 IVAs registered per month in the three-month period ending March 2022, 12% higher than for the three-month period ending March 2021 and 14% higher than the three-months ending March 2019.

Breathing Space Registrations

Between 4 May 2021 (when the scheme was launched) and 31 March 2022 there were 58,463 breathing space registrations. These composed of 57,555 standard breathing space registrations and 908 mental health breathing space registrations (for those receiving mental health crisis treatment).

In March 2022 there were 6,261 breathing space registrations. This was made up of 6,139 (98.1%) standard breathing space registrations and 122 (1.9%) mental health breathing space registrations.

Advice

We publish a summary of the reports here each month. For advice relating to support, insolvency or recovery options, please contact us.

* This content and data was reported in full in the Insolvency Service Statistics for March 2022 published 22 April 2022 – see the full report here:

Monthly Insolvency Statistics, March 2022 – GOV.UK (www.gov.uk)

Image source: The Insolvency Service Monthly insolvency statistics, March 2022