Posted By: Bretts Business Recovery Ltd on 28th August 2020

The boss of a hospital fittings and equipment supplier received a nine-year disqualification after he was caught breaching his previous ban. Medisafe Systems was incorporated in March 2010 and traded as a hospital fittings and equipment supplier....

Read more...

Posted By: Bretts Business Recovery Ltd on 20th August 2020

Are you a contractor with a Personal Service Company (PSC)? Does the IR35 Reform affect you? If so, it may prove advantageous to change your employment status and liquidate your company using an MVL. The IR35 off-payroll reforms came into...

Read more...

Posted By: Bretts Business Recovery Ltd on 14th August 2020

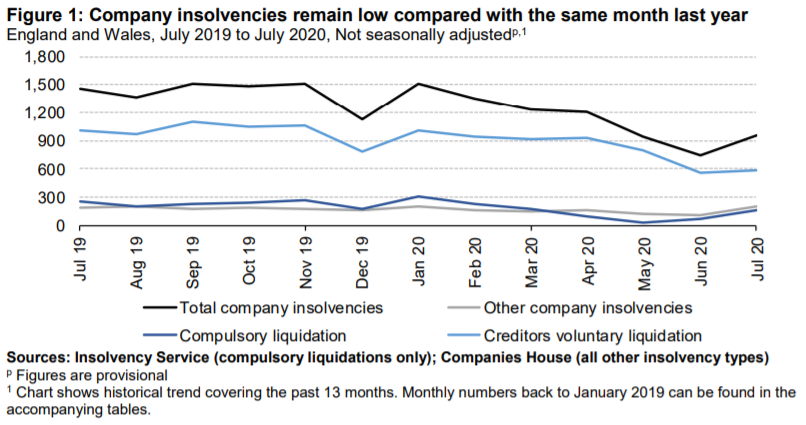

Latest company and individual insolvency statistics remain low overall, but administrations increase by 25% in July 2020 following the failure of two corporate groups. The latest monthly release of insolvency statistics for England and Wales was...

Read more...

Posted By: Bretts Business Recovery Ltd on 30th July 2020

The Finance Act 2020 received Royal Assent on 22 July, confirming that from 1 December 2020 HMRC will become a secondary preferential creditor in insolvencies. This is a disappointing announcement for the insolvency industry which believes the...

Read more...

Posted By: Bretts Business Recovery Ltd on 20th July 2020

Latest company and individual insolvency statistics show little extraordinary variation and remain low when compared to the same month last year. In a bid to provide faster indicators of the impact of the COVID-19 pandemic, the Insolvency...

Read more...

Posted By: Bretts Business Recovery Ltd on 14th July 2020

If you’re looking to retire and take reserves out of your company, a Members Voluntary Liquidation may be the best strategy Economic downturns are often seen as a time of opportunity for those willing to face the challenge head on. Contemporary...

Read more...

Posted By: Bretts Business Recovery Ltd on 9th July 2020

Provisions added to Finance Bill ensure funds received through coronavirus business support schemes are included as revenue for income tax and corporation tax purposes. Recent amendments were made to the Finance Bill which is currently being...

Read more...

Posted By: Bretts Business Recovery Ltd on 7th July 2020

A key provision of The Corporate Insolvency and Governance Act which came into force on 26 June 2020, is to introduce a corporate moratorium – an extendable 20-working day period giving businesses protection from creditor action while they seek...

Read more...

Posted By: Bretts Business Recovery Ltd on 6th July 2020

Director of Sandy Hill Food and Wine Limited, Harmon Singh Madhan has been disqualified from being a director for 5 years. The investigation into the business, which ceased trading on 04 March 2019, found that Mr Madhan failed to ensure that Sandy...

Read more...

Posted By: Bretts Business Recovery Ltd on 30th June 2020

The Corporate Insolvency and Governance Act has received Royal Assent and came into force on 26 June 2020. The Act, which raced through Parliament in a matter of weeks, introduces new corporate restructuring tools and temporary easements to give...

Read more...