Insolvency statistics released for January 2021

Latest company and individual insolvency statistics remain low.

The latest monthly release of insolvency statistics for England and Wales was published on 19th February 2021. *

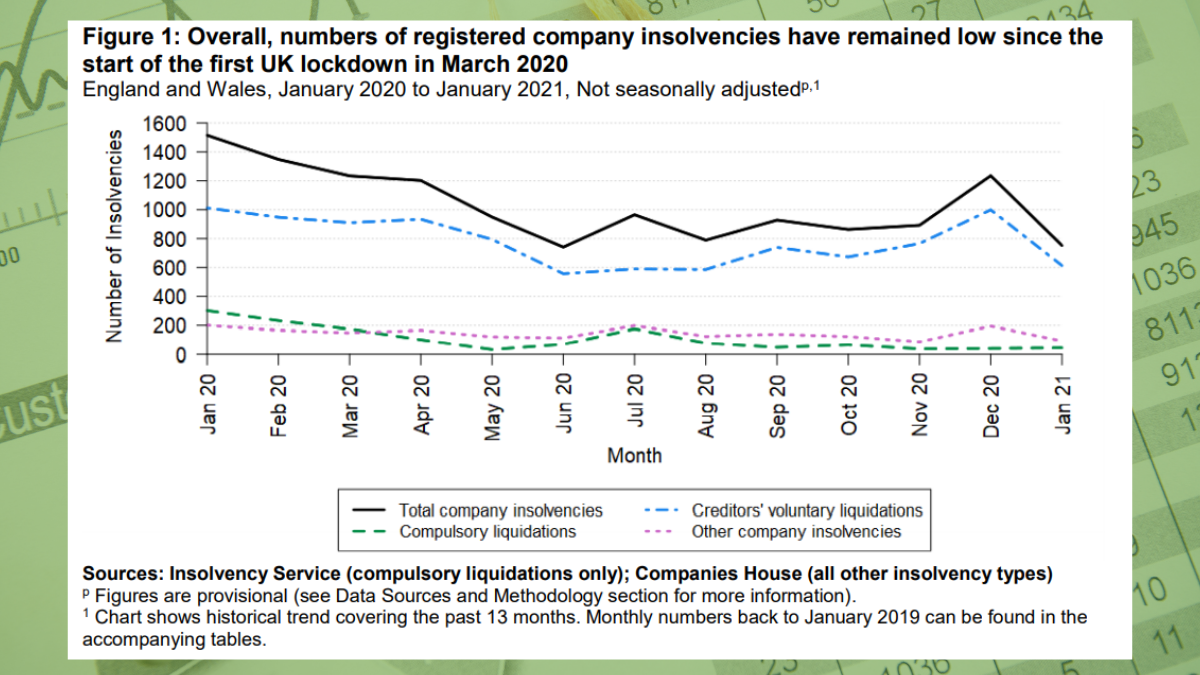

Overall numbers of company and individual insolvencies have remained low since the start of the

first UK lockdown in March 2020, when compared with the same time period last year.

Impact of COVID-19 business support measures

The overall low numbers are likely to be at least partly driven by Government measures set up in response to the coronavirus (COVID 19) pandemic, including:

- Reduced court and tribunal operations and reduced HMRC enforcement activity since the UK lockdown was applied

- Temporary restrictions on the use of statutory demands and certain winding-up petitions (leading to company compulsory liquidations) from 27 April and extended further to 31 December 2020 under the extensions to the Corporate Insolvency and Governance Act.

- Enhanced Government financial support for companies and individuals.

As the Insolvency Service does not record whether an insolvency is directly related to the coronavirus pandemic, it is not possible to state its direct effect on insolvency volumes.

The statistics in detail – January 2021*

Company insolvencies

In January 2021 there was a total of 752 company insolvencies in England and Wales, comprised of:

- 613 CVLs

- 45 compulsory liquidations

- 73 administrations

- 21 company voluntary arrangements (CVAs)

There were no receivership appointments.

When compared with the number of company insolvencies registered in January 2020:

• Compulsory liquidations were 85% lower and CVLs were 39% lower. There were 34% fewer CVAs and Administrations were 57% lower.

So far, December 2020 was the only month since the start of the first UK lockdown in which overall registered company insolvencies were higher than in the same month of the previous year. The January results show that these results are not an ongoing trend.

New procedures introduced by CIGA 2020

Between 26 June 2020 and 31 January 2021, four companies obtained a moratorium and five

companies had a restructuring plan sanctioned by the court. These two new procedures were

created by the Corporate Insolvency and Governance Act 2020. The low number of cases of each

of these new legislative tools since the Act came into force is likely to be as a result of the range of

Government support provided to companies as mentioned above, including the range of temporary

measures that apply until 31 March 20212

Debt relief orders and bankruptcies

There were 1,167 DROs and 818 bankruptcies in January 2021 in England & Wales. The

bankruptcies were made up of 740 debtor applications and 78 creditor petitions. The numbers of

DROs and bankruptcies in January 2021 were both 47% lower than in January 2020. Debtor

applications were 43% lower and creditor petitions were 68% lower.

How the numbers may be affected

The fall in DROs and debtor bankruptcies corresponds with a reduction in applications which coincided with the announcement of enhanced Government financial support for individuals and businesses.

The fall in creditor bankruptcies will likely have been a result of reduced HMRC enforcement activity during this period and in part, a result of reduced operational running of the courts.

Individual voluntary arrangements

There were, on average, 6,950 IVAs registered per month in the three-month period ending January

2021, 17% higher than for the three-month period ending January 2020.

How the numbers may be affected

IVAs are counted once they are registered with the Insolvency Service and are reported by month of registration date. There can be a time lag between the date on which the IVA is accepted (the date of creditor agreement) and the date of registration by licensed insolvency practitioners. This can lead to volatility in the data from one month to the next and create difficulty in constituting reliable short-term trends.

Three-month rolling averages have been calculated to smooth the data and indicate what the overall trend of IVA registrations might look like if the underlying data were less volatile.

Advice

We publish a summary of the reports here each month. For advice relating to support, insolvency or recovery options, please contact us.

* This content and data was reported in full in the Insolvency Service Statistics for January 2021 published 19 February 2021 – see the full report here: Monthly Insolvency Statistics January 2021 – GOV.UK (www.gov.uk)

Image source: The Insolvency Service Monthly insolvency statistics, January 2021