Posted By: Bretts Business Recovery Ltd on 11th April 2021

Cash (flow) really is king... It's important to realise that when a successful business grows it often places more pressure on cash flow which can lead to business failure, even though at a profit and loss level the business is successful. In fact,...

Read more...

Posted By: Bretts Business Recovery Ltd on 7th April 2021

Keith Alan Da Costa of Manningtree in Essex, the sole director of KAD Consultants Limited since its incorporation in May 2011, has been banned for 5 years after failing to provide adequate accounting records and not complying with tax...

Read more...

Posted By: Bretts Business Recovery Ltd on 6th April 2021

New pre-pack regulations have been approved by Parliament and will come into effect at the end of April 2021. What will these new regulations mean and what challenges are they likely to bring? What is a pre-pack? In many cases...

Read more...

Posted By: Bretts Business Recovery Ltd on 18th March 2021

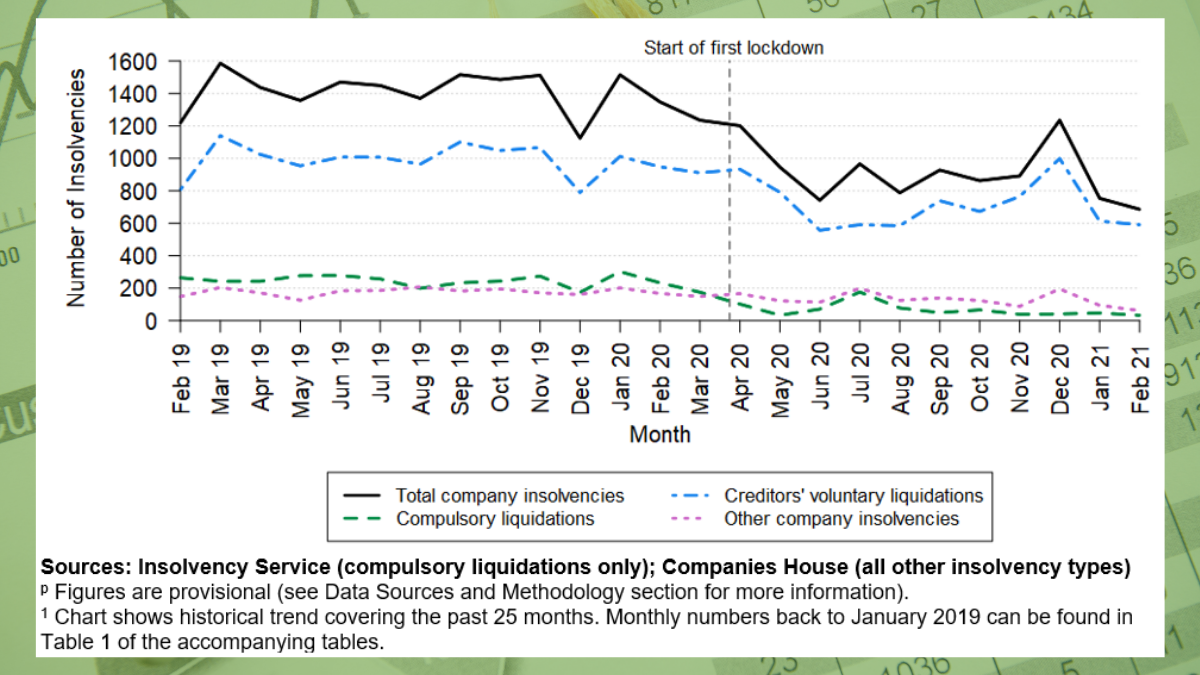

Latest company and individual insolvency statistics are the lowest since January 2019 The latest monthly release of insolvency statistics for England and Wales was published on 16th March 2021. * Overall numbers of company and individual...

Read more...

Posted By: Bretts Business Recovery Ltd on 10th March 2021

If your business becomes insolvent and you need to cease trading and close, there are some options you should consider rather than simply dissolving your company. If you are a director of a limited company, you may also be an employee of the...

Read more...

Posted By: Bretts Business Recovery Ltd on 10th March 2021

Ban for Kent takeaway boss who hid sales to avoid tax Good View takeaway on Watling Street in Dartford was incorporated in April 2016, with Yue Chang Dai (56) the sole Director. The Company was unable to pay its debts and was placed into...

Read more...

Posted By: Bretts Business Recovery Ltd on 19th February 2021

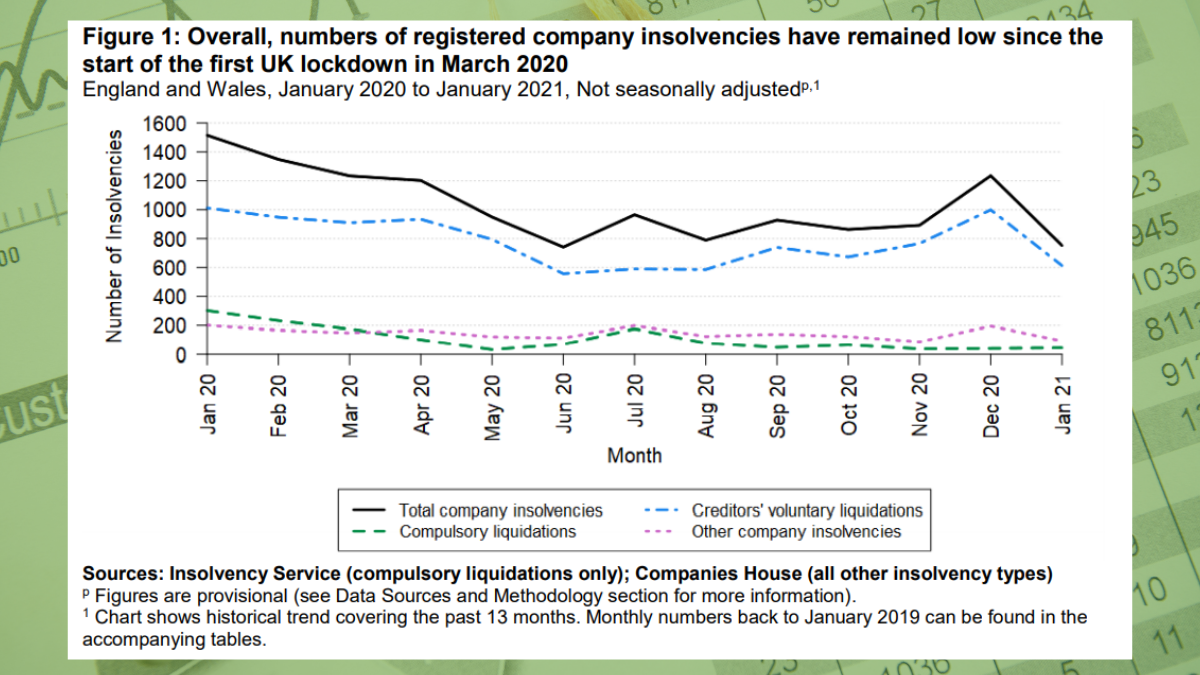

Latest company and individual insolvency statistics remain low. The latest monthly release of insolvency statistics for England and Wales was published on 19th February 2021. * Overall numbers of company and individual insolvencies have...

Read more...

Posted By: Bretts Business Recovery Ltd on 18th February 2021

One of the benefits of running a limited company is that Directors can take the majority of their remuneration as dividends, which is typically a more tax efficient method than taking a PAYE salary. The timing of dividend payments must be...

Read more...

Posted By: Bretts Business Recovery Ltd on 1st February 2021

Two company directors who provided prospective shareholders with false information to secure millions in investments have been banned for a total of 17 years. Lee Anthony Skinner has been banned for 10 years, while Karen Ferreira has...

Read more...

Posted By: Bretts Business Recovery Ltd on 21st January 2021

Proposals have been outlined by the government to increase the financial eligibility criteria for debt relief orders (DROs), helping more people deal with financial difficulties to get a fresh start. Research shows that the demand for debt advice...

Read more...